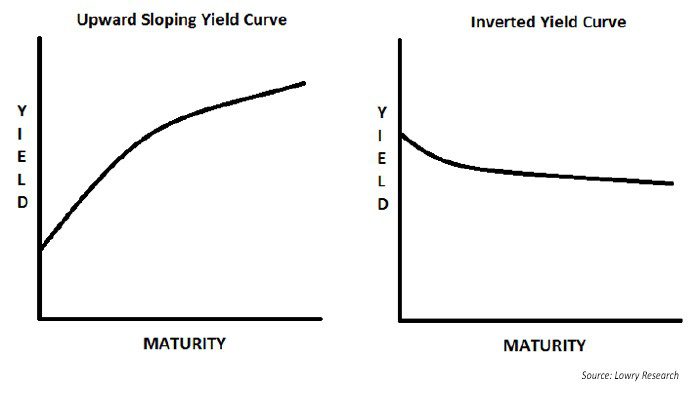

The yield curve is considered inverted when long term bonds traditionally those with higher yields see their returns fall.

What does inverted yield curve indicate.

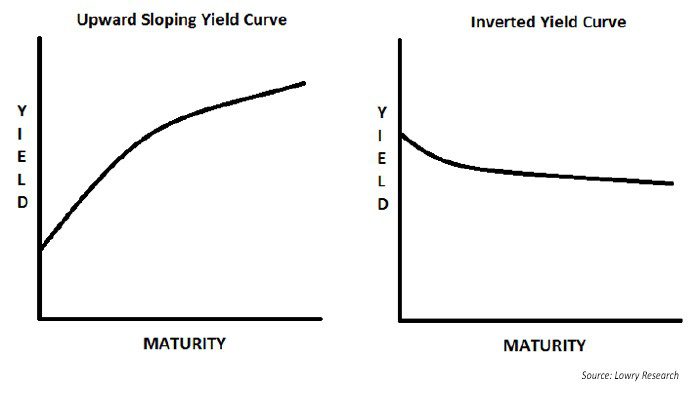

In a normal yield curve.

That s when yields on short term treasury bills notes and bonds are higher than long term yields.

Reuters lucas jackson.

This hasn t happened.

What is a yield curve and what does it mean when it s inverted.

An inverted yield curve is an indicator of trouble on the horizon when short term rates are higher than long term rates see october 2000 below.

The current yield curve is hard to read people fear inverted yield curves because they tend to precede recessions.

In simple terms the yield curve shows the price of borrowing money in the bond market.

The term yield curve refers to the relationship between the short and long term interest rates of fixed income securities issued by the u s.

It won t be immediate but recessions have followed inversions a few months to two years later several times over many decades.

Treasury department sells them in 12 maturities.

What does an inversion in the curve mean.

This chart from the st.

While the yield curve has been inverted in a general sense for some time for a brief moment the yield of the 10 year treasury dipped below the yield of the 2 year treasury.

What an inverted yield curve means.

Louis fed shows the spread between the 10 year and two year treasuries the peaks are periods when the yield curve was steepest while the dips below the zero line indicate that the yield curve was inverted.

An inverted yield curve is generally considered a recession predictor.

An inverted yield curve occurs when short.

They are.

Treasurys with short term bonds paying more than long term bonds.

An inverted yield curve means interest rates have flipped on u s.

It s generally regarded as a warning signs for the economy and.